In mid-August 2025, the China Passenger Car Association (CPCA) and the China Association of Automobile Manufacturers (CAAM) successively released relevant data on the automotive industry and passenger vehicle market for July 2025. CAAM stated that in July, the auto market entered the traditional off-season, with some manufacturers arranging annual equipment maintenance, leading to a slowdown in production and sales pace and a seasonal pullback on a MoM basis. From the perspective of the industry market environment, the effects of the trade-in policy continued to manifest, positive progress was made in the comprehensive rectification of the "rat race" competition in the industry, and enterprises continued to launch new car models, contributing to the stable operation of the auto market and achieving YoY growth... SMM compiled relevant data on the auto market and power battery market for July for readers to peruse and understand.

Automobiles

CAAM: July auto production and sales both increased by over double digits YoY, with production and sales exceeding 18 million units in the first seven months

In July, auto production and sales reached 2.591 million units and 2.593 million units respectively, down 7.3% and 10.7% MoM,but up 13.3% and 14.7% YoY. From January to July, auto production and sales reached 18.235 million units and 18.269 million units respectively,up 12.7% and 12% YoY, with production and sales growth rates expanding by 0.2 and 0.6 percentage points respectively compared to January-June.

CAAM: July NEV production and sales exceeded 1.2 million units, accounting for 48.7% of total auto sales

According to CAAM data, in July, NEV production and sales reached 1.243 million units and 1.262 million units respectively,up 26.3% and 27.4% YoY, with NEV new car sales accounting for 48.7% of total new auto sales. From January to July, NEV production and sales reached 8.232 million units and 8.22 million units respectively,up 39.2% and 38.5% YoY, with NEV new car sales accounting for 45% of total new auto sales.

CAAM: July auto exports increased by 22.6% YoY, with NEV exports increasing by 84.6% YoY in the first seven months

In July, auto exports reached 575,000 units, down 2.8% MoM,but up 22.6% YoY. From January to July, auto exports reached 3.68 million units,up 12.8% YoY.

In July, NEV exports reached 225,000 units,up 10% MoM and 1.2 times YoY. Among them, passenger NEV exports reached 220,000 units, up 11.9% MoM and 1.2 times YoY; commercial NEV exports reached 5,000 units, down 36.8% MoM but up 76.5% YoY. January-July, NEV exports reached 1.308 million units, up 84.6% YoY. Among them, passenger NEV exports totaled 1.254 million units, up 81.6% YoY, while commercial NEV exports reached 54,000 units, doubling YoY.

The Passenger Car Association (PCA) also released the July 2025 passenger vehicle market data. PCA figures show July's national passenger vehicle retail sales reached 1.826 million units, up 6.3% YoY, down 12.4% MoM. Year-to-date cumulative retail sales hit 12.728 million units, up 10.1% YoY.

For NEVs, July's passenger NEV wholesale sales reached 1.181 million units, up 24.4% YoY, down 4.8% MoM. January-July cumulative wholesale sales totaled 7.629 million units, up 35.2% YoY

. Export-wise, PCA noted that as China's NEV scale advantages and market expansion become evident, domestically produced NEV brands are increasingly going global with growing overseas recognition. Plug-in hybrids accounted for 32% of NEV exports (26% in the same period last year). Despite recent external disruptions, independent plug-in hybrid exports to developing countries grew rapidly with bright prospects. July's passenger NEV exports reached 213,000 units, up 120.4% YoY, up 7.6% MoM, representing 44.7% of passenger vehicle exports, nearly 20 percentage points higher YoY. Pure EVs accounted for 65.3% of NEV exports (73.8% last year), with A00+A0 segment EVs as the core focus, making up 43% of pure EV exports (26% last year).

Regarding July's passenger vehicle market, PCA observed that this year's domestic retail growth rate continuously rose from 1.2% in January-February to 10.8% in January-June, with July showing a high-base deceleration characteristic, following a "low start, mid-year peak, and later stabilization" trend. July retail sales grew 3% YoY to 1.768 million units compared to July 2023's record high, demonstrating solid growth.

PCA highlighted seven key characteristics of July 2025's passenger vehicle market: 1. July set monthly records for producer retail sales, exports, wholesale, and production, with NEV exports reaching an all-time monthly high. 2. January-June domestic retail sales achieved 10.8% cumulative YoY growth, while January-July growth moderated to 10.1% as July's 6.3% growth pulled down the cumulative rate by nearly 1 percentage point, indicating the emerging "low start, mid-year peak, and later stabilization" pattern. 3. This year's visible price war showed mild trends, but hidden incentives like annual model upgrades, enhanced owner benefits, the "program of large-scale equipment upgrades and consumer goods trade-ins" policy, and increased producer subsidies proliferated. July's NEV sales promotions remained flat MoM at 10.2%. 4. July's pure EV retail sales grew 24.5% YoY, while plug-in hybrids fell 0.2% and range-extended EVs dropped 11.4%. Among new automakers, the pure EV vs. range-extended structure shifted from last year's 43:57 to 64:36. 5. As anti-"rat race" competition deepened, overall producer and channel inventory fell by 90,000 units in July (110,000 units last year), with NEV inventory down 60,000 units. 6. July's NEV domestic retail penetration rose to 54.0%, showing steady strong growth underpinned by retirement/renewal, trade-in policies, and NEV purchase tax exemptions. 7. January-July traditional fuel passenger vehicle exports fell 9% YoY to 1.76 million units, while NEV exports surged 57% to 1.2 million units, with independent NEVs accounting for 39.0% of independent exports.

Power Batteries

From January to July 2025, the cumulative sales of power and other batteries in China reached 786.2 GWh, up 60.6% YoY.

In July, the sales of power and other batteries in China were 127.2 GWh, down 3.2% MoM, up 47.8% YoY. Among them, the sales of power batteries were 91.1 GWh, accounting for 71.6% of the total sales, down 3.1% MoM, and up 45.8% YoY; the sales of other batteries were 36.1 GWh, accounting for 28.4% of the total sales, down 3.4% MoM, up 52.9% YoY.

From January to July, the cumulative sales of power and other batteries in China reached 786.2 GWh, up 60.6% YoY. Among them, the cumulative sales of power batteries were 576.6 GWh, accounting for 73.3% of the total sales, up 50.6% YoY; the cumulative sales of other batteries were 209.6 GWh, accounting for 26.7% of the total sales, up 96.2% YoY.

From January to July 2025, the power battery installations in China reached 355.4 GWh, up 45.1% YoY.

In July, the power battery installations in China were 55.9 GWh, down 4.0% MoM, up 34.3% YoY. Among them, the installations of ternary batteries were 10.9 GWh, accounting for 19.6% of the total installations, up 1.9% MoM, and down 3.8% YoY; the installations of LFP batteries were 44.9 GWh, accounting for 80.4% of the total installations, down 5.3% MoM, up 49.0% YoY.

From January to July, the cumulative power battery installations in China reached 355.4 GWh, up 45.1% YoY. Among them, the cumulative installations of ternary batteries were 66.5 GWh, accounting for 18.7% of the total installations, down 9.7% YoY; the cumulative installations of LFP batteries were 288.9 GWh, accounting for 81.3% of the total installations, up 68.8% YoY.

Delivery Volumes of Multiple NEV Manufacturers Hit Record Highs, CPCA Raises Annual Forecast

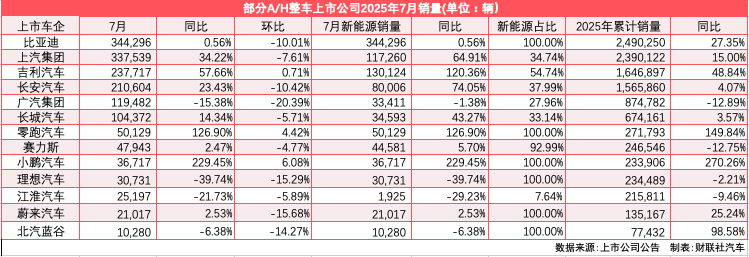

The following figure shows the performance of 13 A/H-share listed automakers in July as compiled by a reporter from Cailian Press. Among them, 9 automakers achieved YoY growth, accounting for nearly 70%. GAC Group, JAC, Li Auto, and BAIC BluePark saw a YoY decline.

Reviewing the sales performance of the auto market in July, BYD, known as the "electric vehicle leader," sold 344,300 units in July, up 0.56% YoY, with a slowdown in growth and a 10.01% MoM decline; from January to July, the cumulative sales reached 2.4902 million units, up 27.35% YoY, maintaining its position as the "leader."

Additionally, the delivery volumes of Xiaomi, Leap Motor, and XPeng Motors in July all reached new monthly highs. Specifically, Leap Motor delivered 50,129 units across its entire lineup in July, up over 126% YoY, achieving a monthly delivery volume exceeding 50,000 units for the first time and securing the top position among new automakers for the fifth consecutive month. XPeng Motors delivered 36,717 smart EVs in July, up 229% YoY, also setting a new monthly delivery record. Furthermore, Xiaomi Motors announced in an article that it delivered over 30,000 new vehicles in July. Although Xiaomi did not disclose specific figures, it also set a new monthly delivery record.

In contrast, Li Auto, which once ranked high in sales, showed a slightly weaker performance in July. It delivered only 30,700 units in July, down 15.3% MoM and 39.7% YoY. Compared to the 51,000 units sold in the same period last year, it experienced a monthly decrease of over 20,000 units. In the first seven months, Li Auto delivered a cumulative 235,000 new vehicles, down 2.2% YoY. It is reported that Li Auto adjusted its sales target from 700,000 units at the beginning of the year to 640,000 units in May. Based on the adjusted target delivery volume, Li Auto's current target completion rate is around 36.72%.

NIO delivered 21,017 units in July, up 2.53% YoY and down 15.68% MoM. It delivered a cumulative 135,167 units in 2025, up 25.24% YoY. Previously, NIO set a sales target of 440,000 units, which was proposed based on its expected full-year sales of around 220,000 units in 2024, aiming to achieve a 100% YoY increase in sales.

The China Association of Automobile Manufacturers (CAAM) commented that in July, the auto market entered the traditional off-season, with some manufacturers arranging annual equipment maintenance, leading to a slowdown in production and sales rhythms and a seasonal pullback MoM. From the perspective of the industry market environment, the trade-in policy continued to show effects, and positive progress was made in the comprehensive regulation of the "rat race" competition within the industry. Automakers continued to launch new car models, supporting the stable operation of the auto market and achieving YoY growth. Among them, NEVs continued to grow rapidly, and auto exports remained stable.

The Central Political Bureau meeting held on July 30 comprehensively deployed economic work for the second half of the year, clarifying that macro policies should continue to exert force and be strengthened in a timely manner, effectively releasing domestic demand potential and promoting the continuous optimization of market competition order. Recently, the national level has allocated the third batch of ultra-long-term special treasury bonds to support the trade-in of consumer goods. The fourth batch will be allocated as planned in October, and local governments will be urged to refine their fund usage plans to ensure the orderly and balanced utilization of funds until the end of the year. The clarity of national policies will help stabilize consumer confidence, continuously boost automobile consumption, and ensure the smooth operation of the industry in the second half of the year (H2).

Cui Dongshu, Secretary General of the China Passenger Car Association (CPCA), stated that in July, retail sales, exports, wholesale sales, and production of passenger cars by producers all reached record highs for the month. The domestic retail penetration rate of new energy vehicles (NEVs) rose to 54%, demonstrating a strong and steady growth driven by inclusive policies such as retirement and renewal, trade-in policies, and the exemption of purchase tax for NEVs.

Based on this, the CPCA has revised upward its annual industry forecast for 2025: retail sales of passenger cars are expected to reach 24.35 million units in 2025, a 6% increase, with the total forecast volume being 300,000 units higher than the June forecast; exports of passenger cars are expected to reach 5.46 million units in 2025, a 14% increase, with the total forecast volume being 160,000 units higher than the initial forecast at the beginning of the year.

Looking ahead to August, the CPCA stated that there will be 21 working days in August 2025, one fewer than the same period last year, providing relatively ample time for production and sales. With the structural differentiation in the growth of the automobile market, some enterprises have ample capacity for traditional internal combustion engine vehicles (ICEVs). Against the backdrop of shrinking market demand for ICEVs, the characteristics of destocking are evident. Factories of ICEV automakers have gradually entered the traditional summer vacation period for equipment maintenance, and the automobile market entered a lull period from late July to early August.

Due to the launch of the "trade-in" policy in July 2024, the sales base for August this year will be relatively high. In late July this year, the third batch of subsidy funds has been distributed to various regions. It is expected that the trade-in policy will be restarted in some areas of Chongqing, with more diversified subsidy methods, which is expected to improve the growth rate in August. Given the high production enthusiasm of producers at the beginning of this year, the industry did not exhibit the destocking characteristics seen in previous years. At the end of June, inventory reached 3.32 million units, with 49 days of inventories. The inventory levels of ICEVs and NEVs are at a relatively reasonable level. Therefore, it is expected that the steady trend of producing based on sales will continue in August.